OK, I figured out how to put a Favicon and a graphic on my blog page.

I chose a stylized cartoon of a Bull and Bear, the classic market struggle between the optimists and the pessimists.

I don't see it that way. To me we are all the same. We are trying to make some money and we can do that regardless of the market direction, if we have the right strategies and mindset.

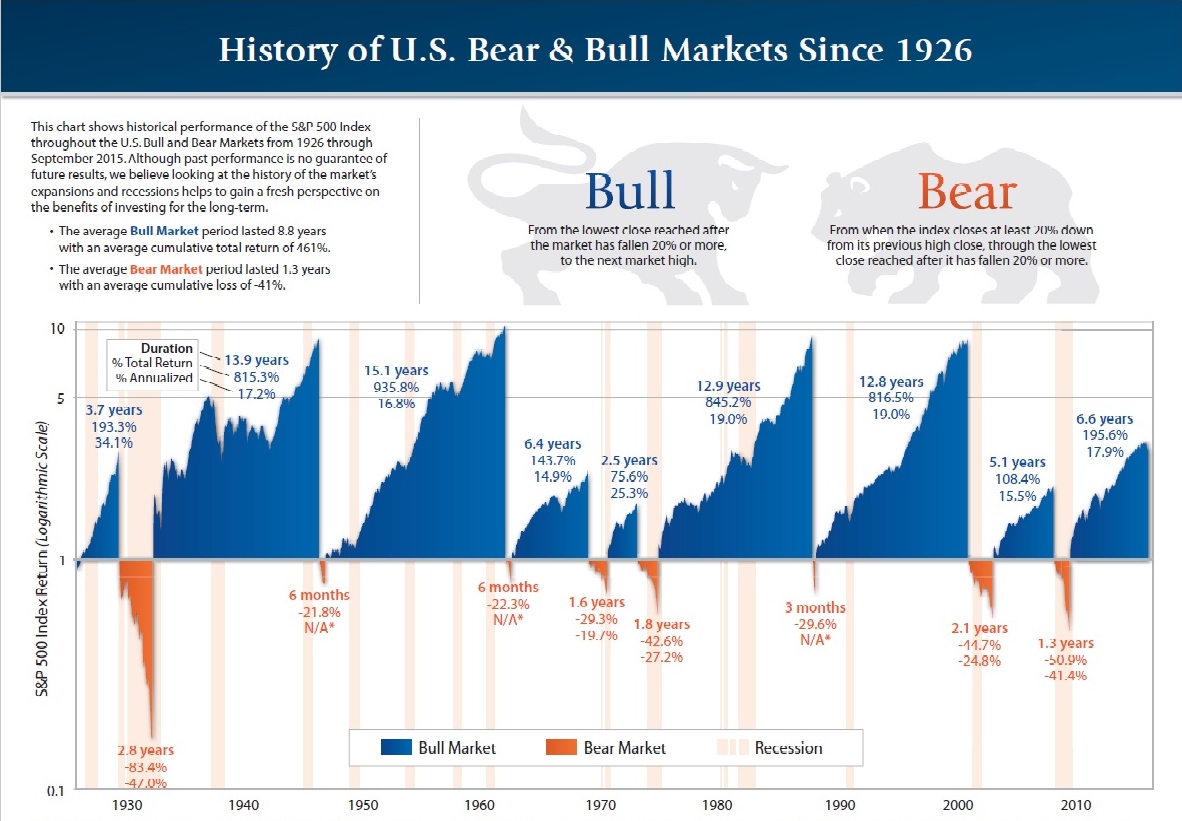

Bull markets are more more prevalent and enduring than Bear markets. Bear markets are short-lived and more severe, as illustrated in the graph below.

The main problem with this traditional viewpoint for the average "Investor", is that they always lag the market and just as they are getting very Bullish and buying into the market prices start to decline, the market falls out from under them, fear kicks in and they end up selling at the bottom of the Bear phase just as things start to recover. They are to scared to get back in until the Bull market has matured and the cycle repeats itself.

Trading the S&P 500 futures, I believe, is more manageable and safer than trading the underlying stocks. It is easier to have a single strategy on a single investment vehicle that allows you to trade both sides of the market than trying to follow a basket of stocks that behave randomly and are more susceptible to dips and dives based on the irrational day to day events in the world, within their sectors and the company itself.

Comments

Post a Comment